Algorhythms

2015

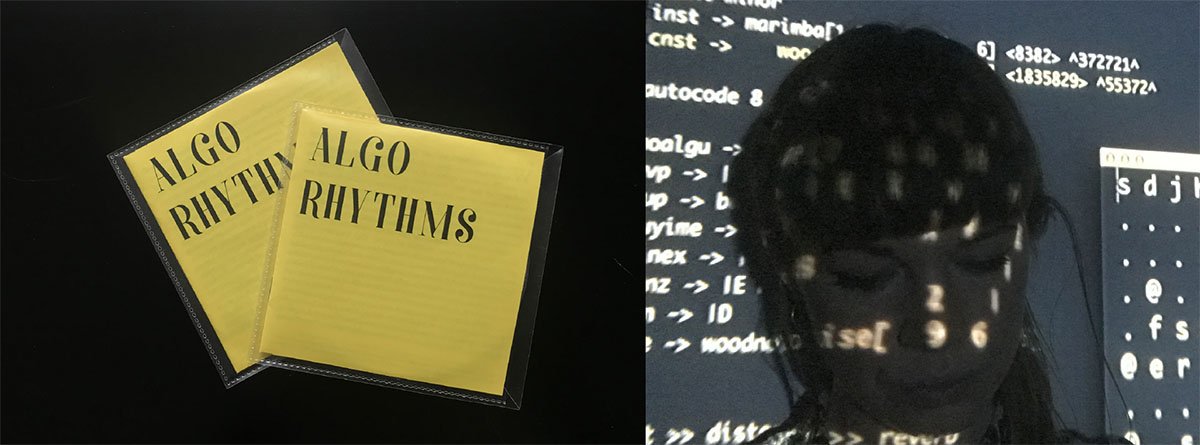

Algorithms, unlike other mathematical abstractions, operate in time. The temporality of the algorithm means that it is also an algorhythym, a musical pattern that travels over time. In this musical performance lecture, which later became a zine and EP, the algorithm is appropriated from the realm of high-frequency financial trading (HFT) and capital, and into the realm of sound and play.

Algorithms, among other things, often decide the fate of the stock market, together constituting the ‘abstract machine’ of capital. High frequency trading (HFT) through algorithms has, for the most part, now replaced the bodily semaphore of the stock exchange floor. Trades that used to take human traders around 12 seconds are now complete in a matter of milliseconds. These speeds are, quite literally, unthinkable, yet millions of dollars are spent each year to make transactions faster still. In this world beyond our perception, fractions of a millisecond can make or break fortunes. Through speed and opacity, these algorithms disappear from view. Algo-rhythms is a speculative act of algorithmic appropriation.

After a brief introduction to HFT, generative music performed via ixi lang and Supercollider posits a different kind of relation to the algorithm. In contrast to the ‘black box’ of financial algorithms, the code here is visible, its results are audible. In this way, the algorithm becomes a site of potential jouissance.